Retirement Fund Fundamentals Advanced

The Retirement Fund Fundamentals Advanced course goes beyond the basic obligations of loyalty, care, and prudence to address the unique complexities and challenges associated with managing pension assets and serving the best interests of plan participants. Trustees have a fiduciary responsibility to carry out their duties in a manner that demonstrates care, diligence, and good faith. Continued learning and remaining abreast of latest developments is important in meeting these obligations.

Key concepts

This course is designed to train you to deal with advanced aspects relating to retirement funds and provides the advanced knowledge necessary for trustees. It is assumed that participants have a basic understanding of the duties of trustees, and basic structures of retirement funds.

The course is designed to:

- Build upon the understanding of the retirement fund industry and how retirement funds operate,

- Build upon the understanding of the legal duties of a trustee,

- Introduce trustees to good governance, understanding the key principles for good governance and the impact of these for trustees of retirement funds,

- Help understand the roles of the employer, board, and administrator in the day-to-day operations of the fund,

- Help understand the insurance policies that a fund typically has and how the various insurance arrangements operate and the benefits these provide.

Syllabus

The course consists of 4 modules and will take approximately 8 hours of learning time to complete, including assessments and exercises.

Modules 1 - 4

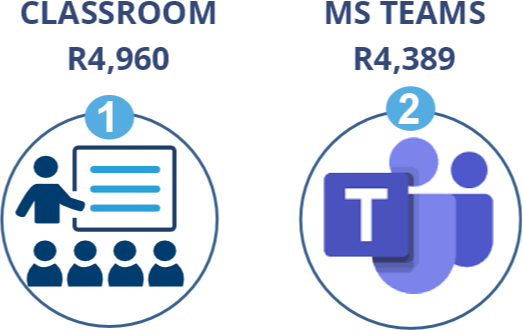

Course fees

All costs are per delegate and exclusive of VAT. Bulk discounts are available for groups of 5 or more.

This course provides trustees with the additional knowledge needed to perform their duties. It alerts trustees to what further learning is required to adequately conduct this key role and covers a range of advanced topics for any trustee wishing to fulfil their duties with due care and attention.

Testimonials